reverse sales tax calculator california

Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales. California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2613.

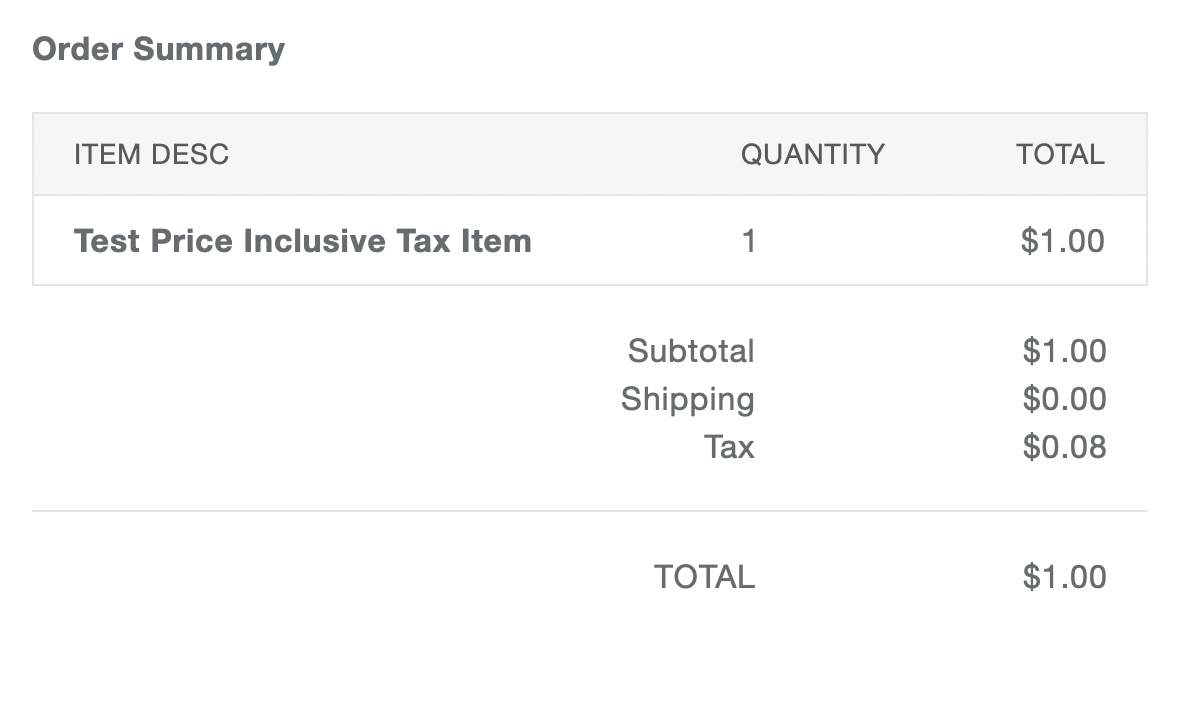

Automatically Collect Tax On Invoices Stripe Documentation

GST Calculator Good and Service Tax Reverse Sales Tax Formula.

. Easily E-File to Claim Your Max Refund Guaranteed. Enter the sales tax percentage. Here is how the total is calculated before sales tax.

Due to rounding of the amount without sales tax it is possible that the method. The Sales Tax Formula used to calculate the final price inclusive of tax before tax price in case of Reverse Sales Tax is provided below. Here is how the total is calculated before sales tax.

Just enter the five-digit zip. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. The formula looks like this.

This reverse tax calculator will help. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. Enter an amount into the calculator above to find out how what kind of sales tax youll see in.

Before Tax Amount 000. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

Total price including tax list. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Plus Tax Amount 000.

The formula looks like this. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Total price including tax list price sales tax or.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Price before Sales Tax.

Just enter the five-digit zip. Reverse Sales Tax Calculations. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures.

Sales TaxFinal Price Inclusive of Tax Before Tax. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. For example if the sales tax rate is 6 divide the.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. The following formula can be used to calculate the original price of an item given the sales tax and the. Sales Tax Calculation Formulas.

Formulas to Calculate Reverse Sales. Ad Calculate Your 2022 Tax Return 100. Sales tax rate sales tax percent 100.

Reverse Sales Tax Computation Formula. Sales tax list price sales tax rate. Minus Tax Amount 000.

California Sales Tax Calculator

California Sales Tax Calculator And Local Rates 2021 Wise

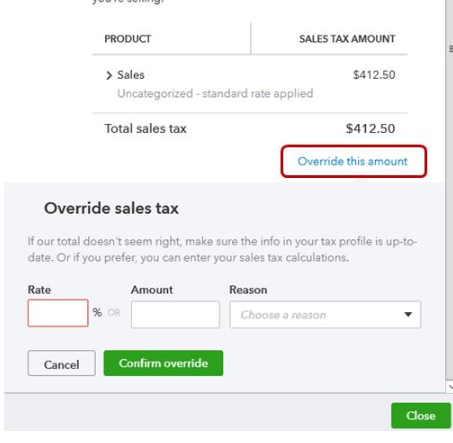

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Corporate Tax In The United States Wikipedia

Precious Metals Irs Reporting Requirements Bullion Exchanges

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Square Online Tax Settings Square Support Center Us

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Easily Calculate Sales Tax Gst In Google Sheets Yagisanatode

Us Sales Tax Calculator Reverse Sales Dremployee

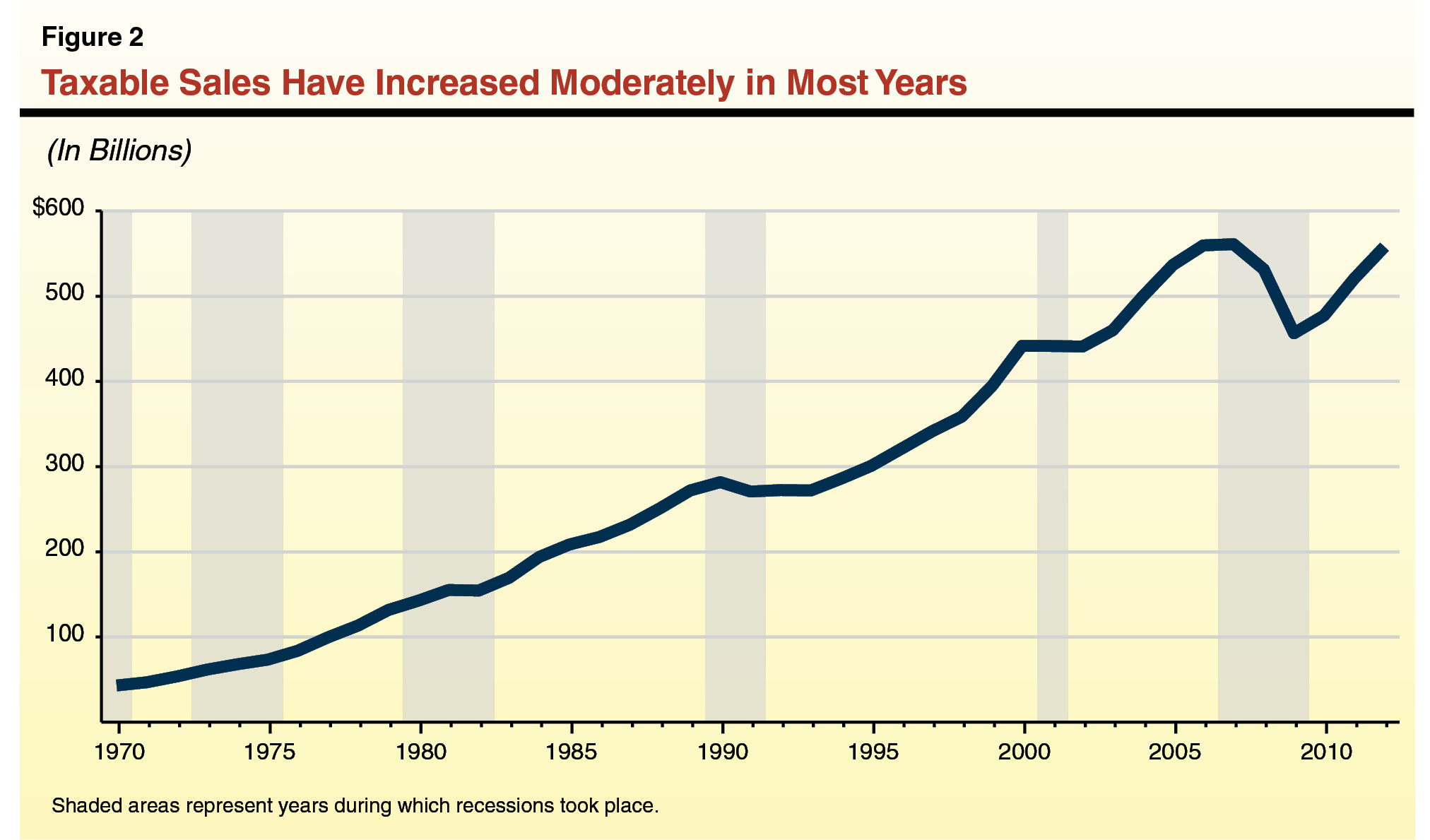

Understanding California S Sales Tax

Why Have Sales Taxes Grown Slower Than The Economy

/dotdash-reverse-mortgage-or-home-equity-loan-v3-eb9ddc756b1d47adba885c60bf2f854c.jpg)

Reverse Mortgage Vs Home Equity Loan Vs Heloc What S The Difference

Los Angeles Sales Tax Rate And Calculator 2021 Wise

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System